(as of 03/31/2024)

Overview

The Riverbridge Smid Cap Growth Portfolio was established in 2006. It is a diversified growth stock portfolio invested in 40-60 companies of small to mid market capitalization sizes. Due to our long-term investment approach, turnover for the portfolio is low – averaging less than 20% annually. The portfolio is managed by the Riverbridge Investment Team utilizing our time-tested investment philosophy and disciplines.

Investment Philosophy

Riverbridge believes earnings power determines the value of a business, therefore we invest in high quality growth companies that possess the ability to build their earnings power at above-average rates for long periods of time. We define earnings power as companies achieving high returns on invested capital while possessing an enduring strategic advantage in their marketplace. We build portfolios by identifying and buying well-managed companies we believe can maintain consistent unit growth and strong free cash flow, allowing them to finance their growth using internally generated sources of capital.

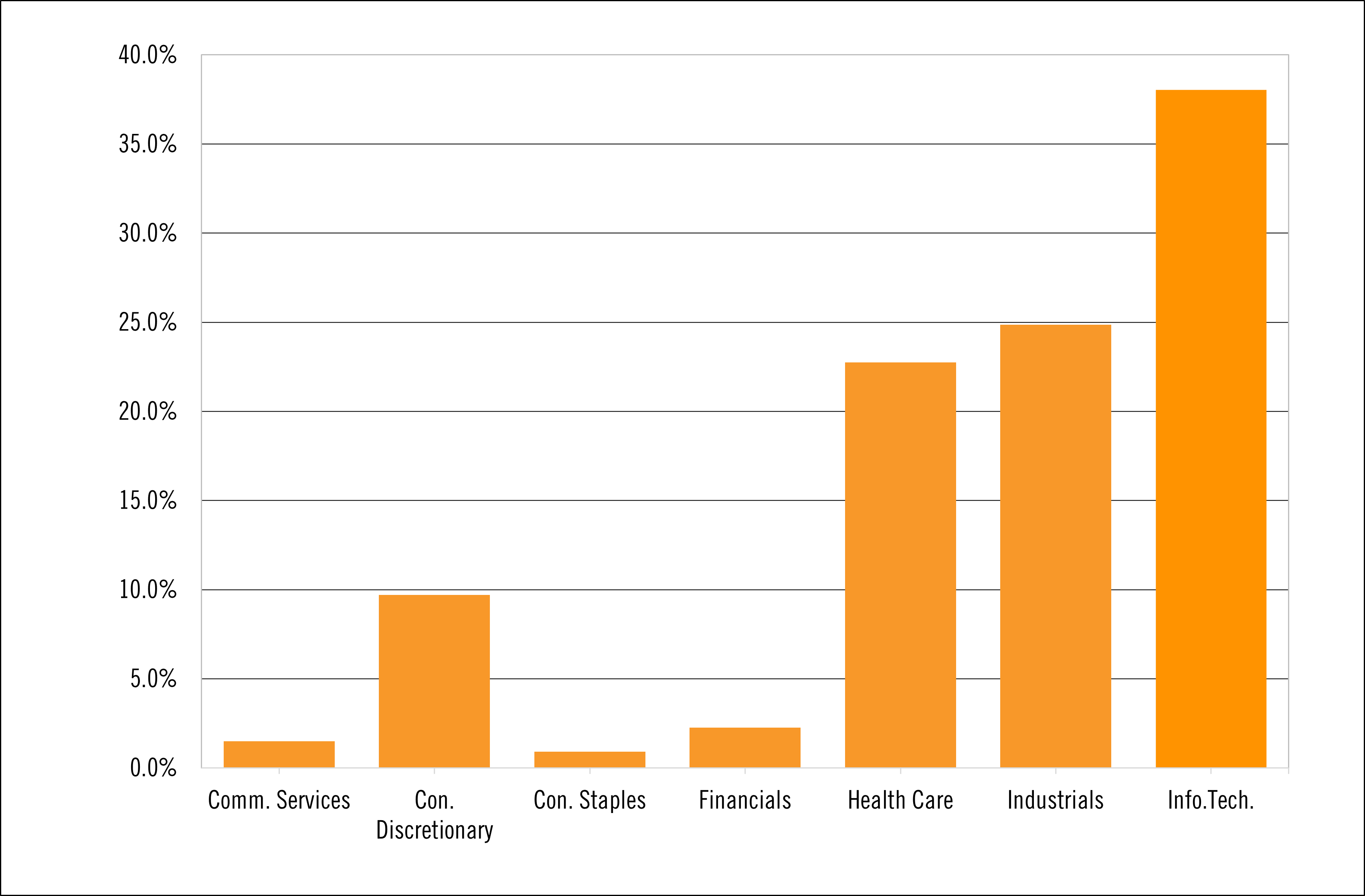

Sector Weightings

(as of 03/31/2024)

| Inception Year | 2006 |

| Number of Holdings | 51 |

| Wgt. Avg. Market Cap | $14.3 billion |

| 5-Year Turnover | 15.60% |

| Investment Vehicles | Separate Account, CIT |

(as of 03/31/2024)

| HEICO Corporation | 4.34% | |

| West Pharmaceutical Services, Inc. | 3.94% | |

| Tyler Technologies, Inc. | 3.63% | |

| Globant S.A. | 3.59% | |

| Grand Canyon Education, Inc. | 3.34% | |

| Five Below, Inc. | 3.29% | |

| RB Global, Inc. | 3.01% | |

| Ansys, Inc. | 2.96% | |

| Paycom Software, Inc. | 2.76% | |

| Floor & Decor Holdings, Inc. | 2.67% | |

| TOTAL | 33.54% |